Off the Chain — June 2025⚙🚛📦

Our usual industry news and M&A, plus a deep dive into our thesis on New Product Development and the players we're backing in its upgrade cycle!

Connect with us: Caitlin Vorlicek, Raaga Kannan, Dorothy Shapiro, Mike Crowe

New Product Development Pain🤒

Despite the consistent buzz of supply chain innovation, it’s no secret that old, outdated technology persists within enterprises. There may be several reasons for this including lack of prioritization or reluctance to replace older systems due to bad memories of arduous implementations. This month we’re shining a spotlight on the New Product Development category, a space where our own portfolio is feeling the “pull” of an inevitable upgrade cycle. At the same time enterprises are eager to leverage AI advancements to speed product innovation, most companies first need to get the data related to their Research and Development efforts in order.

Some of the digital solutions traditionally involved in the R&D process include Electronic Lab Notebooks, Laboratory Information Systems, Specification Management, Regulatory Reporting, Product Lifecycle Management and Quality Management. These systems and processes are highly dependent on data, yet data management has been manual, siloed and inaccurate. Modern systems of record built on modern technology using cutting edge development processes provide better alternatives.

We’re seeing alternatives for R&D organizations coming from two directions in our own portfolio. In both cases, Net Promoter Scores for these companies are dramatically higher than the traditional systems they replace. Specright, which manages specification data for all materials (e.g. packaging, raw, semi-finished, finished, equipment) and provides capabilities for supplier management, sustainability reporting and quality management, is getting pulled by food & beverage companies to provide a PLM-alternative solution, asking the question – “if all my product data is here, why do I need a PLM?” Earlier in the product development lifecycle, Uncountable, which provides a state of the art, unified alternative for electronic Lab Notebooks and Laboratory Information Management systems, is getting pulled by chemicals and materials companies to similarly provide PLM and Quality alternatives.

We see tremendous opportunity to utilize Artificial Intelligence to speed new product development. Both Specright and Uncountable help get companies on that path, first by getting their data right and, second, by applying AI capabilities against that improved data foundation. We believe staying power for traditional PLM exists in more industrial-focused end markets, where the minutiae of process control is critical to the outcome of the product (see Boeing’s challenging 2024).

We think the $30bn PLM category is in for significant disruption, and are thrilled to be backing some of the most innovative companies ready to do so.

Off the Press📰

Greenlit for Green Corridors: With a presidential permit secured, Green Corridors has announced an ambitious $10b Intelligent Freight Transportation System (ITLS) between Laredo and Monterrey as a modern, autonomous solution to surging cross‑border traffic and tariff-induced bottlenecks. Fully privately funded and set to open by 2031, the initiative dovetails with nearshoring trends and underscores the urgency of resilient US–Mexico trade infrastructure.

Load of Controversy: The feud between Project44 and FourKites hit a new high this week as FreightWaves CEO Craig Fuller called out FourKites CEO Matt Elenjickal for misrepresenting Fuller’s comments to cast doubt on Project44’s Movement platform. The controversy has sparked a broader industry debate about innovation vs. spin, but we were focused on a different line in Fuller’s post that called P44’s visibility a “commodity.” We agree that data aggregation-based visibility platforms increasingly lack differentiation (not to mention reliability), and that’s why we’re backing ground truth sources of visibility data like Tive!

Truckstop Hits Reverse: Kendra Tucker is out as Truckstop CEO, with founder Scott Moscrip back behind the wheel. Tucker battled one of the most turbulent freight environments and invested in product areas key to industry challenges such as freight fraud, but insiders have voiced concerns over scattered acquisitions and inconsistent execution. Many in the industry are excited for Moscrip’s return and hope it’s a chance to refocus on customer-centric innovation. As for us, we’ll be keeping an eye out to see what Tucker does next.

Off the Street💰

While it was a lighter month for M&A on the tech front, Japanese steelmaker Nippon Steel at last finalized their $15b acquisition of US Steel after more than 18 months of negotiations. The discussions culminated in a “golden share” agreement, a unique national security provision that gives the US government veto power to ensure American oversight — a key concern in an era of heightened scrutiny over foreign ownership of critical industries. Indeed, the move feels squarely in the context of the Trump administration’s “America First” trade policy, with high tariffs on foreign steel, new incentives for domestic manufacturing, and a renewed focus on supply chain resilience all making US-based investment more attractive.

By guaranteeing billions in new investment, preserving American jobs, and keeping US Steel’s leadership and headquarters stateside, the deal aligns with the national push to boost domestic manufacturing while showing that foreign investment is welcome — as long as it comes with strong commitments to US interests and security.

Off the Charts📈

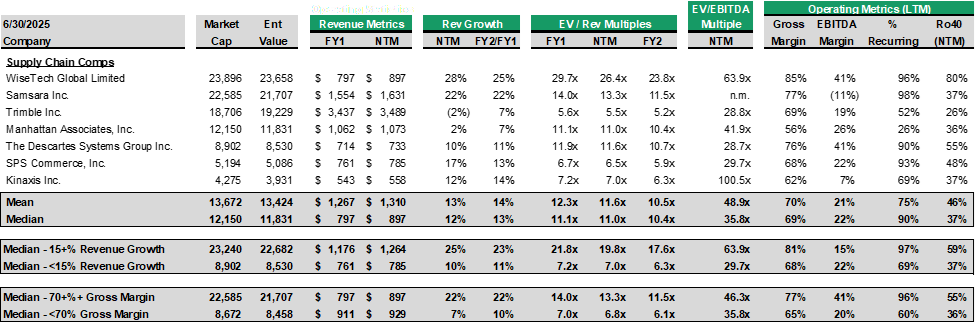

Chart: Public Company Multiples1:

Our team tracks seven publicly traded supply chain technology companies: WiseTech, Samsara, Trimble, Manhattan, Descartes, SPS Commerce, and Kinaxis. Mega platforms like SAP, Oracle, and Microsoft are excluded given their mix of revenue beyond supply chain.

Chart: 10-Year Trading Multiples – EV / NTM Revenue & Revenue Growth:

Revenue multiples are generally correlated with NTM revenue growth, with an inverse trend post-COVID.

Current median NTM revenue multiple: 11.0x

Current median NTM revenue growth: 12.5%

10-year median NTM revenue multiple: 8.7x

Chart: 10-Year Trading Multiples – EV / NTM Revenue2:

Supply chain technology companies today are trading at a premium relative to the broader SaaS universe.

Current median Supply Chain NTM revenue multiple: 11.0x

Current median SaaS NTM revenue multiple: 4.3x

Chart: 10-Year Trading Multiples – Companies Growing +/-15%3:

There is a growing bifurcation of value for companies growing +/- 15%.

Current high growth median NTM revenue multiple: 19.8x

Current low growth median NTM revenue multiple: 7.0x

Chart: 10-Year Trading Multiples – Companies with +/-70% Gross Margin4:

Companies with SaaS-like gross margins (70%+) trade at a significant premium to companies with <70% gross margins.

Current high margin median NTM revenue multiple: 13.3x

Current low margin median NTM revenue multiple: 6.8x