Off the Chain — June 2024⚙🚛📦

This month we’re shining a spotlight on 3PL M&A, The FreightWaves Future of Freight Conference in Atlanta, and headlines across supply chain disruption, market movements, and labor challenges.

Connect with us: Mike McClure, Caitlin Vorlicek, Catherine Cable, Dorothy Shapiro, Mike Crowe

Off the Street💰

June was a big month for M&A in the 3PL market, with RXO’s announced agreement to acquire Coyote Logistics from UPS and Transfix’ sale of its brokerage division to NFI. RXO is now the third largest brokerage by 2023 gross revenue, up from spot #8, while NFI moved up 10 spots to #32.1 There’s plenty of recommended coverage on the deals2, but our team has two key takeaways:

Value of technology – there’s no doubt that tech will play a critical role in the future of freight brokerage. However, we’re seeing a shift in how the market values tech from internal, proprietary systems to third-party providers. UPS purchased tech-forward Coyote Logistics for $1.8bn in 2015 and sold it in 2024 for ~$1bn3, while Transfix is divesting its brokerage unit to become a stand-alone TMS, and all this comes with the background of Convoy’s bankruptcy earlier this year. These moves make sense to us: with razor-thin margins, it’s hard for home grown tech to compete with stand-alone providers.

Logistics market segmentation – even within OTR, logistics markets are unique and strengths in one market do not necessarily translate to strengths in another. While there are synergies in providing both LTL and truckload services, those synergies don’t extend to the parcel market, as evidenced by UPS’ failed integration of Coyote (and its 2021 sale of Overnite to TFI, also at a loss). Couple this with FedEx’ impending sale of its LTL unit. It’s often tempting to consider moving into adjacent markets, but we think too much strategy drift can be a risky playbook in logistics.

Off the Road✈

This month, Dorothy headed to Atlanta for the Future of Supply Chain Conference hosted by FreightWaves and enjoyed the sessions just as much as the merch offerings (her “What the Truck?!?” hat is a new staple on her desk). We’d be remiss not to shout out the Best in Show winner MyCarrier, which received much-deserved recognition for its robust platform that is shaking up the nature of relationships in the LTL market! Other prominent topics included the role of Gen AI and the continued freight fraud challenge.

Off the Press📰

Back in Business: The Port of Baltimore has fully re-opened, 11 weeks after a cargo ship hit the Francis Scott Key Bridge and caused its collapse. The port is poised for a rebound as bookings resume, and will hopefully begin to relieve other burdened ports and increase visibility.

Early Peak?: The National Retail Federation predicts that import cargo levels will hit their highest levels since 2022 this summer, suggesting an early peak season. Debate swirls, however, over whether the surge signals an early peak or an extended one that will last into the fall.

Disruption Déjà Vu: Rates are soaring due to disruption in the Red Sea and a severe drought in the Panama Canal, causing fears of a COVID-like waterborne gridlock and even prompting dockworkers to threaten strike. Despite the potential distress, we see an opportunity for tech companies, especially those focused on port and maritime visibility, to get ahead of the issue.

Amazon Under Fire: the eCom giant paid out $6m in fines this month for failing to disclose performance quotas to warehouse workers. The lawsuit highlights the need for better employee engagement and communications solutions to ensure both ethical supply chains and warehouse labor retention.

Off the Charts📈

Chart: Public Company Multiples4:

Our team tracks eight publicly traded supply chain technology companies: WiseTech, Samsara, Trimble, Manhattan, Descartes, SPS Commerce, Kinaxis, and E2open. Mega platforms like SAP, Oracle, and Microsoft are excluded given their mix of revenue beyond supply chain.

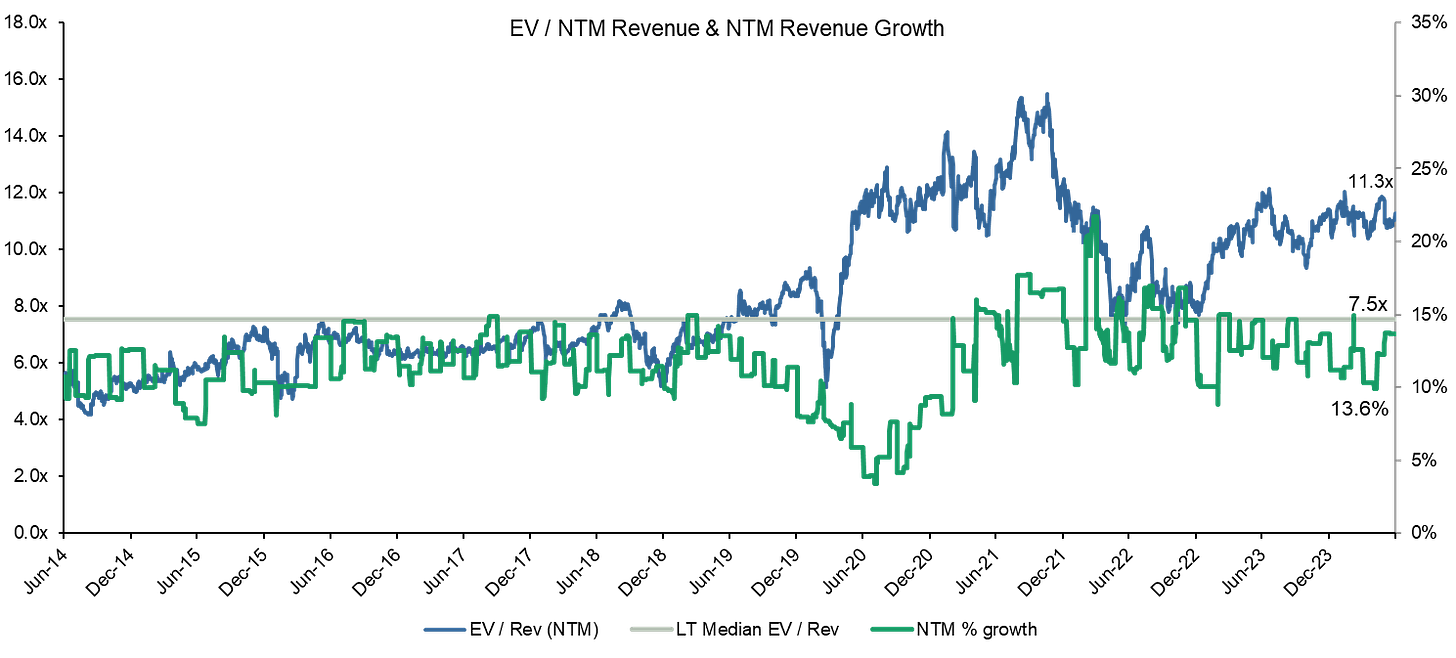

Chart: 10-Year Trading Multiples – EV / NTM Revenue & Revenue Growth:

Revenue multiples are generally correlated with NTM revenue growth, with an inverse trend post-COVID.

Current median NTM revenue multiple: 11.3x

Current median NTM revenue growth: 13.6%

10-year median NTM revenue multiple: 7.5x

Chart: 10-Year Trading Multiples – EV / NTM Revenue5:

Supply chain technology companies today are trading at a premium relative to the broader SaaS universe.

Current median Supply Chain NTM revenue multiple: 11.3x

Current median SaaS NTM revenue multiple: 4.5x

Chart: 10-Year Trading Multiples – Companies Growing +/-15%6:

There is a growing bifurcation of value for companies growing +/- 15%.

Current high growth median NTM revenue multiple: 12.1x

Current low growth median NTM revenue multiple: 8.4x

Chart: 10-Year Trading Multiples – Companies with +/-70% Gross Margin7:

Companies with SaaS-like gross margins (70%+) trade at a significant premium to companies with <70% gross margins.

Current high margin median NTM revenue multiple: 13.8x

Current low margin median NTM revenue multiple: 5.9x