Off the Chain — January 2025⚙🚛📦

Q4 earnings make waves, the first few weeks of the new administration, and another buzzy month of M&A!

Connect with us: Mike McClure, Caitlin Vorlicek, Raaga Kannan, Dorothy Shapiro, Mike Crowe

(Almost) Off the Road✈

After Patrick Mahomes’ and Jalen Hurts’ big game on the 9th, your beloved OTC authors will be headed to their very own Super Bowl at Manifest in Las Vegas next week. Hope to see you there!

Off the Radar🚨

UPS and Manhattan Associates rocked the supply chain public markets in their Q4 earnings releases, both announcing disappointing growth expectations for 2025. UPS announced it is cutting 50% of its low margin Amazon business as it doubles down on more profitable segments. Meanwhile, Manhattan lowered its 2025 guidance to just 2-3% YoY growth, largely due to a professional services revenue adjustment. We view both of these movements as more of a realignment than an endemic decline in demand…though we’ll be paying close attention as the rest of our comp set announces earnings!

Off the Press📰

Following President Trump’s inauguration, there have been a flurry of developing stories. We suspect we’ll be covering them more in the coming months as they continue to shake out.

Funding on Ice… Then Defrosted: On the 27th, Trump ordered then quickly rescinded a freeze on $3T of federal funding in the name of efficiency. Supply chain impacts would have included halted infrastructure projects, longer processing times at customs, and interrupted air freight schedules, among others. Net net, it seems that if Trump and Musk get their way, we could see significant transportation delays, particularly among international shipments. We’ll be watching to see what they can push through.

Trouble in Panama: Trump is challenging Panama’s operation of the Panama Canal with claims of exorbitant fees for American ships and, more obscurely, creeping Chinese influence. The President wants to “take back” oversight of the waterway for both US economic and security interests. While we won’t comment on the security implications, it feels obvious that any attempt to “retake” control of the Canal (especially one involving our military) would severely interrupt transit times and cost of goods, potentially inspiring alternate routes like the Suez Canal or land bridges. Which brings us to…

Tariff Time: Technically we’re already into February news, as Trump has ordered 25% tariffs on imports from both Mexico and Canada (which have since been halted) and a 10% tariff on Chinese goods, while also closing the de minimus tax loophole. We’ll refer back to our November issue where we discussed possible implications for rising costs, supply chain disruptions, reshoring and rerouting, etc. as these tariffs move into effect.

So far, the common theme here seems to be a fast-moving and often unpredictable administration, with both significant policy overhauls and quick reversals. We’ll be watching if, which, and how supply chains manage to stay nimble and adapt to the turbulence.

Off the Street💰

We have to start our private transactions with our very own investment in Tive! See our most recent post for a deep dive. Taken alongside Springcoast’s investment in Overhaul, it was a big month for visibility plays riding, among other tailwinds, the growing freight theft problem.

On the 2nd, Cass Information Systems, one of the largest, shipper-focused freight audit and payment platforms, announced it had acquired AcuAudit from Acuitive Solutions. Armed with the AcuAudit platform for ocean, air, and drayage, Cass’ offerings now span every mode of transportation. The global freight audit and payment market is projected to grow at a 14% clip over the next 5+ years, driven in large part by increased digitization, a tailwind that Cass is capitalizing on both organically and inorganically.

On the 7th, UK-based Achilles Information announced its acquisition of GRMS, a US-based provider of supplier risk management solutions. This acquisition marks a continuation of Achilles’ global expansion strategy (acquired Spain-based GoSupply in 2024) by adding supplier density in the attractive North American market. As supply chain risks have proliferated, so too have supplier risk management solutions, resulting in “portal fatigue” across suppliers. With this backdrop, investing in network effects and portal consolidation feels like a smart play for Achilles, especially as it looks to expand internationally.

On the 20th, digital maritime solutions provider Marcura announced it acquired Vesselman, a dry-docking and technical project management solution for ship managers. Marcura customers can now manage the entire vessel life cycle in the platform, while VesselMan’s customers will benefit from Marcura’s extensive supplier network. It seems that the trend of tech consolidation has reached maritime, as tech providers seek to offer more comprehensive, end-to-end solutions.

And finally, on the 24th, the PE-backed enterprise supply chain giant Aptean announced plans to acquire supply chain planning provider Logility (Nasdaq: LGTY) in an all-cash transaction valuing the business at ~$400m EV, a 27% premium to its trading price and ~3.8x NTM revenue. Logility has had its fair share of identity crises over the years, divesting its transportation division in 2023 and chipping away at its cloud migration. The identity crisis appears to continue: while the press release is laced with flashy AI comments, it also confirms that a new home for Logility has been a long-time coming, as Logility's Chairman claimed they have "consistently evaluated the Company's stand-alone plan against other strategic opportunities."

Off the Charts📈

Chart: Public Company Multiples1:

Our team tracks eight publicly traded supply chain technology companies: WiseTech, Samsara, Trimble, Manhattan, Descartes, SPS Commerce, Kinaxis, and E2open. Mega platforms like SAP, Oracle, and Microsoft are excluded given their mix of revenue beyond supply chain.

Chart: 10-Year Trading Multiples – EV / NTM Revenue & Revenue Growth:

Revenue multiples are generally correlated with NTM revenue growth, with an inverse trend post-COVID.

Current median NTM revenue multiple: 10.5x

Current median NTM revenue growth: 13.1%

10-year median NTM revenue multiple: 8.1x

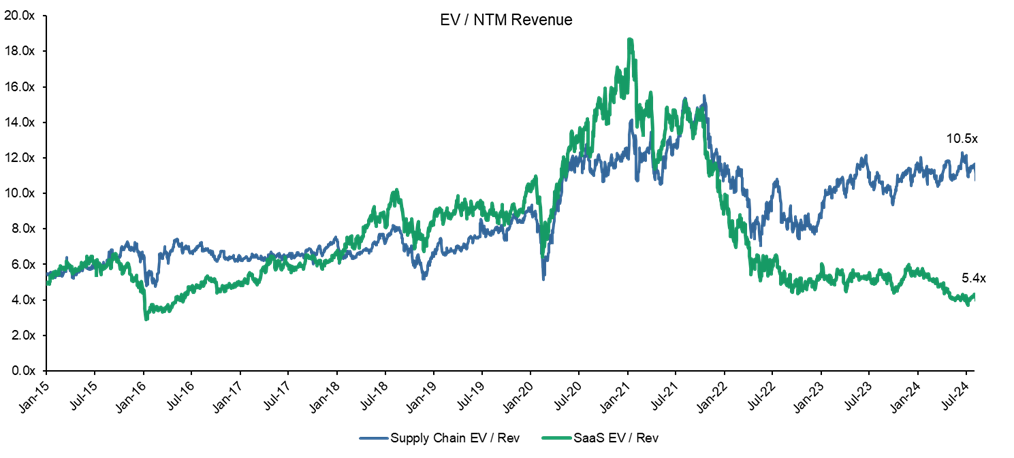

Chart: 10-Year Trading Multiples – EV / NTM Revenue2:

Supply chain technology companies today are trading at a premium relative to the broader SaaS universe.

Current median Supply Chain NTM revenue multiple: 10.5x

Current median SaaS NTM revenue multiple: 5.4x

Chart: 10-Year Trading Multiples – Companies Growing +/-15%3:

There is a growing bifurcation of value for companies growing +/- 15%.

Current high growth median NTM revenue multiple: 14.3x

Current low growth median NTM revenue multiple: 8.6x

Chart: 10-Year Trading Multiples – Companies with +/-70% Gross Margin4:

Companies with SaaS-like gross margins (70%+) trade at a significant premium to companies with <70% gross margins.

Current high margin median NTM revenue multiple: 19.4x

Current low margin median NTM revenue multiple: 5.7x