Off the Chain — February 2025⚙🚛📦

Manifest recap, more freight tech consolidation, and continued disruption in the public markets...

Connect with us: Caitlin Vorlicek, Raaga Kannan, Dorothy Shapiro, Mike Crowe

Off the Road✈

We attended Manifest and saw a LOT of you all! This was the conference’s biggest year yet with over 6,000 attendees - go Pam! We were energized by all of the familiar faces and activity and are already marking our calendars for next year.

The big themes were unsurprisingly a continued focus on supply chain data quality and how AI can leverage that data, whether that’s in visibility, security, workflow automation, or other use cases. Unlike the ghost of blockchain’s past, we think the AI theme is here to stay and look forward to tracking many of the innovative ideas that filled the expo hall. And a bonus shoutout to our very own Caitlin’s panel on M&A in today’s Supply Chain landscape!

Off the Radar🚨

More commotion in February on Wall Street (or Down Under?) as WiseTech’s share price fell ~20% after four of its six board members resigned, even amidst a strong earnings report. It seems the market’s question is whether WiseTech, now or in the future, will ever be able to successfully transition from Founder Richard White, who is inextricably linked to the business’ product strategy.

Off the Press📰

Freight Recession Turnaround?: Per-mile truckload linehaul rates grew 0.6% month-over-month January, marking the first year-over-year positive change (0.8%) since December 2022. While the positive inflection suggests a potential turnaround, the question remains: will modest growth be enough to overcome ongoing challenges like private fleet capacity additions and looming industry regulations, or are we looking at a prolonged, gradual recovery throughout 2025?

USTR Rocks the Boat: While we won’t try and cover every tariff headline from February, we will mention one particularly relevant supply chain announcement. As Trump announced additional 10% tariffs on China, the United States Trade Representative (USTR)’s latest proposal attempts to curb China’s dominance in global shipping by imposing up to a $1.5 million fee per US port entry for Chinese-built ships. With Chinese shipyards producing over 50% of vessels used globally to transport goods, the proposed fees would significantly increase the costs of US imports and exports. In response, we’d expect maritime operators to prioritize Canadian ports and intermodal rail. The key question is how US ship-makers would scale production from fewer than five ships per year to meet USTR’s target of transporting 15% of exports via US vessels by 2032.

Breaking Up💔: Last week, FourKites publicly withdrew from Gartner’s RTTVP Magic Quadrant in a post by CEO Mathew Elenjickal. Social media makes breakups so hard! In all seriousness, we think this is a bold and necessary move by FourKites, as the “RTTVP” market experiences shifting priorities (we’ll reference our Tive blog post one more time…and this hot take we enjoyed reading). We think a focus on AI applications will have more longevity as data ownership and commoditization risks abound for FourKites and Project44.

Off the Street💰

OEC, a leader in automotive aftermarket technology acquired PartsTech, an auto parts procurement platform for mechanical repair shops. While in recent years, OEC has focused on expanding products to address the full repair lifecycle (i.e. RepairLogic and EstimateIQ), the recent acquisition demonstrates a desire to double down on ecommerce, connecting aftermarket suppliers and repair shops. OEC is now poised to strengthen its position in the mechanical repair market by gaining access to PartsTech’s network of suppliers.

Freight tech consolidation continues with Tenstreet, a driver recruitment tool for carriers, acquiring TextLocate, a driver messaging tool. Tenstreet’s CEO said the combination will “augment communications throughout the supply chain, improving relationships and adding new efficiencies.” The announcement reminded us in some ways of DAT’s acquisition of Trucker Tools: both instances of logistics orchestration platforms scooping up a driver communication solution in hopes of infusing their product with real-time, proprietary data to enhance visibility and security.

Fresh off the heels of its ISO acquisition in January, Triumph Financial (Nasdaq: TFIN) leaned further into its data strategy by announcing plans to acquire Greenscreens.ai for $140m in cash and $20m in TFIN stock. As one of the largest factoring and payment providers in freight, Triumph is enabling “confident transacting” by providing “actionable intelligence,” aka pricing (Greenscreens) and performance (ISO) data alongside transactions. We think it’s a smart move and differentiator for Triumph as it continues to digitize payments and expand its market share.

Off the Charts📈

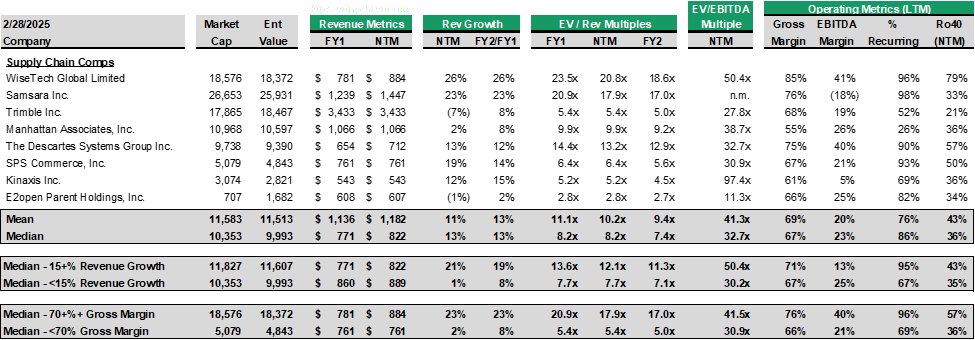

Chart: Public Company Multiples1:

Our team tracks eight publicly traded supply chain technology companies: WiseTech, Samsara, Trimble, Manhattan, Descartes, SPS Commerce, Kinaxis, and E2open. Mega platforms like SAP, Oracle, and Microsoft are excluded given their mix of revenue beyond supply chain. After two months of Off the Radar public stock disruptions, we saw a decrease in EV/NTM revenue multiples — 8.2x, down from 10.5x in January.

Chart: 10-Year Trading Multiples – EV / NTM Revenue & Revenue Growth:

Revenue multiples are generally correlated with NTM revenue growth, with an inverse trend post-COVID.

Current median NTM revenue multiple: 8.2x

Current median NTM revenue growth: 12.6%

10-year median NTM revenue multiple: 8.1x

Chart: 10-Year Trading Multiples – EV / NTM Revenue2:

Supply chain technology companies today are trading at a premium relative to the broader SaaS universe.

Current median Supply Chain NTM revenue multiple: 8.2x

Current median SaaS NTM revenue multiple: 4.5x

Chart: 10-Year Trading Multiples – Companies Growing +/-15%3:

There is a growing bifurcation of value for companies growing +/- 15%.

Current high growth median NTM revenue multiple: 12.1x

Current low growth median NTM revenue multiple: 7.7x

Chart: 10-Year Trading Multiples – Companies with +/-70% Gross Margin4:

Companies with SaaS-like gross margins (70%+) trade at a significant premium to companies with <70% gross margins.

Current high margin median NTM revenue multiple: 17.9x

Current low margin median NTM revenue multiple: 5.4x